We created this calculator to answer a common question –

“What is the maximum loan I could get if I purchase this property?” – and you will get a reference answer for:

Maximum Loan amount (based on the property Loan-to-valuation), installment & minimum income requirement (for personal’s income)

What makes a mortgage agreement?

Generally, there are always two key components for a bank to approve a mortgage application – the quality of the borrower/ guarantor (the human) and the quality of the asset (the property).

Both the quality of the human & the property must be met. The bank credit department WON’T approve the loan purely based on one of the components only.

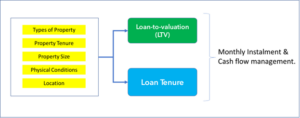

The quality of the borrower is mainly about the borrower’s borrowing capacity, credit rating, litigation free, non-bankruptcy status, age & occupation. To bank, the quality of the property is about types of property, property tenure, physical conditions, size & location. Buyers shall always be informed whether the property could be financed by banks.

Assuming the borrower’s quality is met, the quality of property will determine the Loan-to-valuation and loan tenure.

How does the quality of property affect the Loan-to-valuation & Loan tenure? Or potentially REJECT application?

- Types of property.

Just remember the word – RICH – Residential, Industrial, Commercial & Hotel.

Residential – Over the series of cooling measurements throughout the past decade, the loan-to-valuation (LTV) is always a key parameter to be tightened. In other words, property buyers need to set aside more cash and loan less. Click here for the table of LTV of residential.

Industrial, Commercial & Hotel – The maximum LTV of commercially used property is always about 80% – 90%. The maximum LTV is always for buyers OWN-used. For investment property, the buyers will always get lower LTV, 70% or lower.

In terms of the Industrial property case, some banks REJECT certain types of industry property. Buyers shall take extra caution and consideration for such purchases. - Property Tenure.

Residential – Most of the residential property comes with good property tenure. Even with the shortest property leasehold, 99 years by default, the balance tenure still has a good 60 – 70 years. The loan tenure will then be determined by the borrower’s age.

Industrial – The property tenure does matter, especially the default tenure is only 30 years, and the balance tenure could be less than 20 years. The bank may either reject the application or offer a short, 5 to 15 years, loan tenure. - Property Size.

The built-in size could be a criteria for banks to say “yes” or “no” to applicants. Some banks have set a minimum built-in size. In other words, some banks refuse to offer a loan for the shoebox unit regardless of the location. - Location.

Most Banks say no to the red-light area and surrounding area property. The owners or the buyers could always apply for a mortgage through a finance company. Potentially, the interest rate is slightly higher than the bank rate.

To the buyer, this means you have a lesser choice in accessing bank money.

We hope that our experience will assist you to make a better decision in your purchase. Do engage our consultant for indicative valuation or mortgage advisory.

Other

No Additional Fee payable to RICHCO-SPACE if you apply for a bank mortgage via RICHCO-SPACE.

We assure you that all your information will be kept confidential.