Introduction:

Equity cash out is a financial product that allows property owners to access the equity in their property without having to sell it. This can provide a source of liquidity for major expenses or investments, while still allowing the property owner to retain ownership of the property. In this article, we will provide an overview of equity cash out in Singapore, including what types of property are eligible, how to determine the equity value of a property, and how to choose the best financial institution for an equity cash out loan.

Property as a vehicle for wealth in Singapore

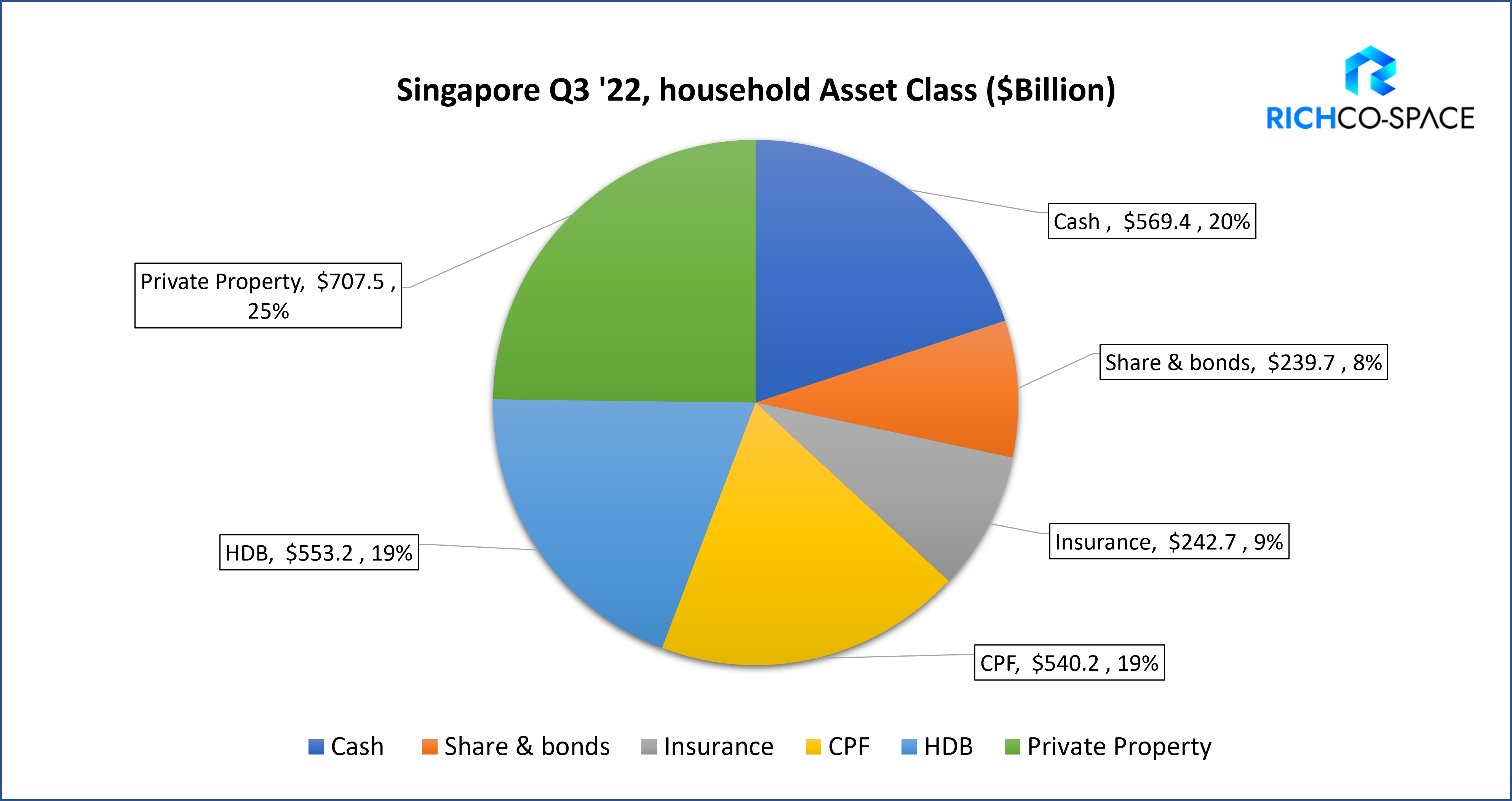

Singapore is a thriving first-tier city in Asia and a global hub for business, education, and living. Property in Singapore not only serves as a place to live, work, and conduct business, but it is also a significant vehicle for wealth. According to Singapore’s statistics for 2022 Q3, the value of family household assets in property is $1,260 billion, or 43% of total assets.

Eligible properties for equity cash out in Singapore

In Singapore, only privately owned property, including residential, commercial, and industrial property, can be used for equity cash out loans. Public housing, such as HDB flats, is not eligible for this type of loan.

Determining the equity value of a property

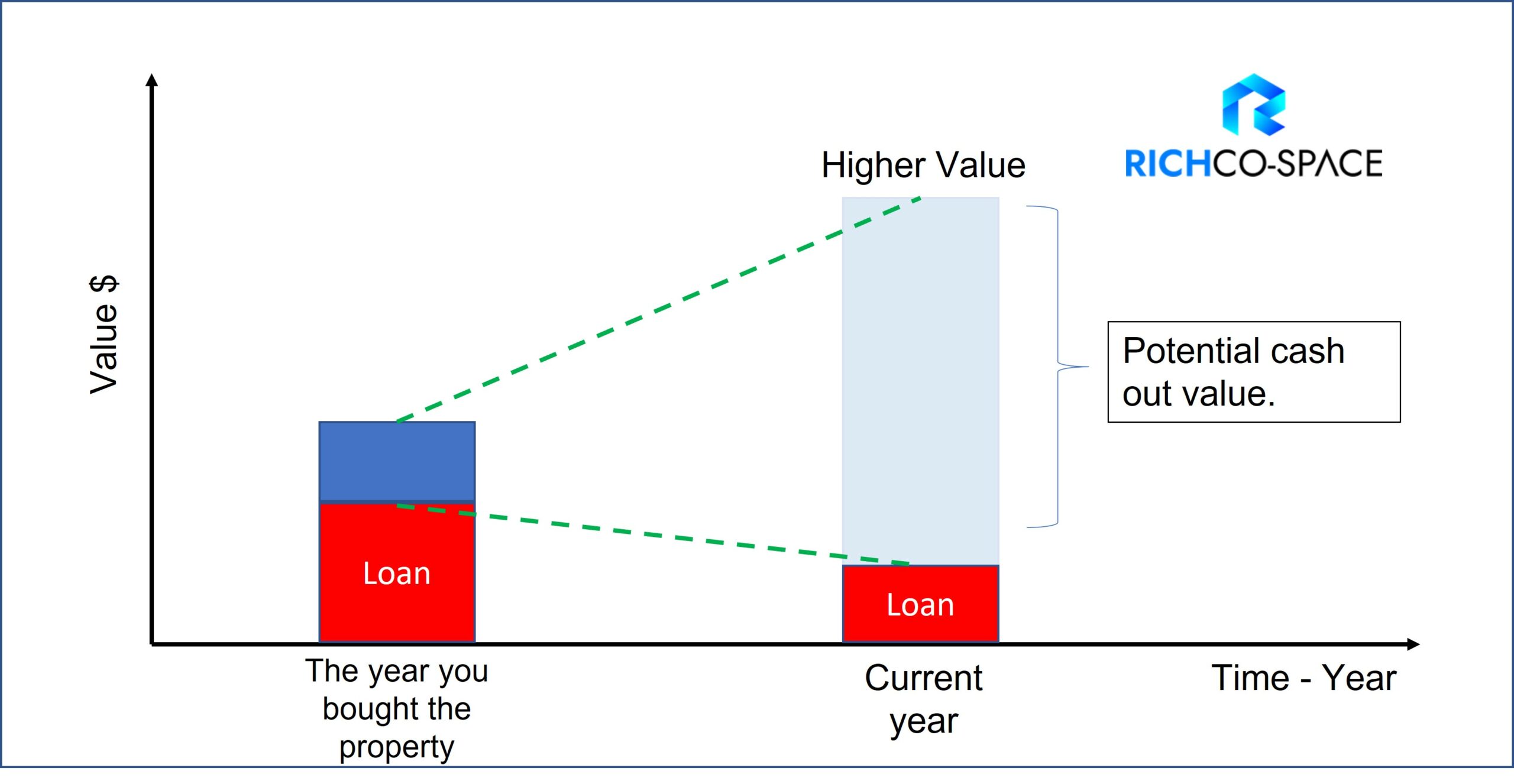

To explore the maximum amount that can be borrowed through an equity cash out loan, it is necessary to determine the equity value of the subject property. The equity value is calculated by subtracting any outstanding mortgage balances and any other liens on the property from the current market value of the property. If the market value of the property has increased since the mortgage was taken out, there may be room for equity cash out.

Is equity cash out the right option for you?

The net cash out amount available from an equity cash out loan is determined by several variables, including the property valuation, the balance of the mortgage, the amount of CPF used (for private residential properties only), and the loan-to-value ratio. If the net cash out amount is relatively low, say $100,000 to $120,000, it may be more beneficial to seek an unsecured loan instead. Unsecured loans do not require collateral, and the approval process is generally faster. However, equity cash out loans may be a better option for larger amounts that can help to fund a business opportunity, investment opportunity, or pay off higher interest rate loans.

Increasing the amount of equity cash out

There are several key factors that can increase the amount of equity that can be accessed through an equity cash out loan. For high-value properties, even a small difference in property valuation, such as 5% to 10%, can make a significant difference in the amount of cash out available.

A condo of $2mil market value, a 10% in dollars will be $200,000. Different people have different needs, a total loan with $400,000 and $600,000 could make an important business decision.

In most cases, first thing first, we will prioritize to find out which of the banks could support a highest valuation. Some of the bank’s panel valuers tend to be more aggressive and some are more conservative. A 5% – 10% difference in valuation becomes the key criteria for choosing the bank.

Secondly, it will be the Loan-to-valuation (LTV) criteria. Banks are required to comply with MAS guidelines in LTV and some banks have their internal guideline for lowering the LTV. LTV 70% and LTV 80% is a big difference as well.

Thirdly, the length you own the property. If you own the private residential property for more than 30 years, sorry to say that, you have no way to apply for equity cash out at all, even if it is a freehold property. For bank equity loan approval, the loan tenure is not only derived based on the borrower, but also the number of years of ownership.

Choosing a lender for an equity cash out loan

When choosing a lender / bank for an equity cash out loan, it is important to consider the property valuation and loan-to-value ratio, as well as the interest rate and terms offered by the lender. In some cases, the bank with the best rates may not offer the highest valuation or most favorable loan-to-value ratio. Alternatively, second or third-tier financial institutions may offer higher loan-to-value ratios and more lenient approval criteria, but at a higher interest rate. It is important to carefully compare the options available and choose.

Key considerations for equity cash out in Singapore

There are several key considerations to keep in mind when applying for an equity cash out loan in Singapore. First, it is important to ensure that the property is privately owned and eligible for this type of loan. Second, it is essential to determine the equity value of the property and consider the factors that can affect the amount of equity that can be borrowed. Third, it is important to choose a lender that offers competitive rates and terms, while also taking into account the property valuation and loan-to-value ratio.

Conclusion:

Equity cash out can provide a source of liquidity for property owners in Singapore who need funds for major expenses or investments without having to sell their property. By understanding the eligibility requirements, determining the equity value of a property, and choosing the right lender, property owners can make informed decisions about whether equity cash out is the right option for them.