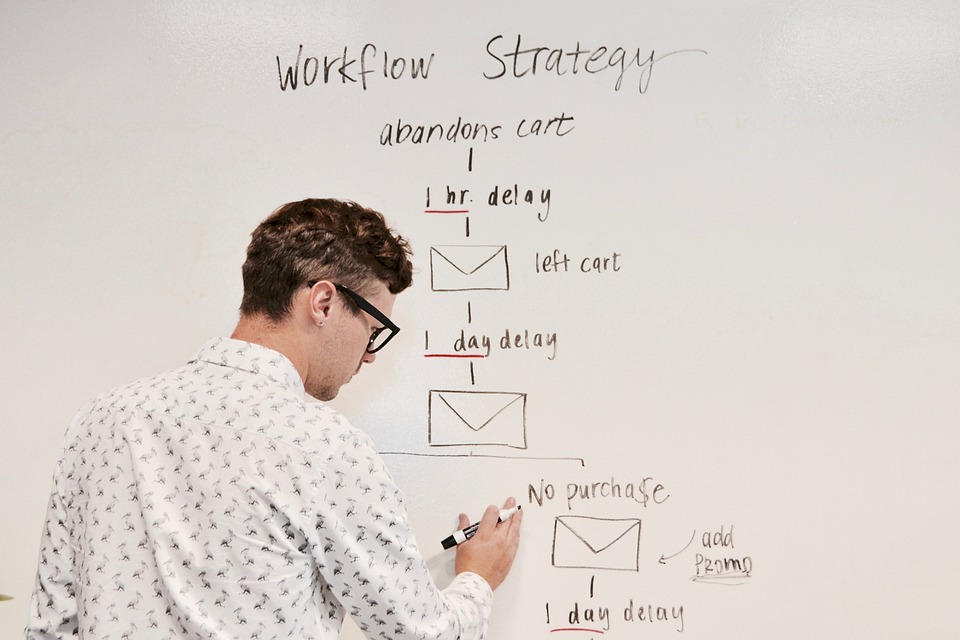

2022 is the year of high inflation and high interest rate. The cost of borrowing increases two, three folds. We all missed years with a good & low 1+% housing loan. We are not here to predict what will happen in the upcoming year, but we would like to share with you some of our thoughts. Let us assist you to make better decisions in choosing a mortgage package.

1. Your mortgage objective come first

There is no one size fits all package, and there is no bank good at all times.

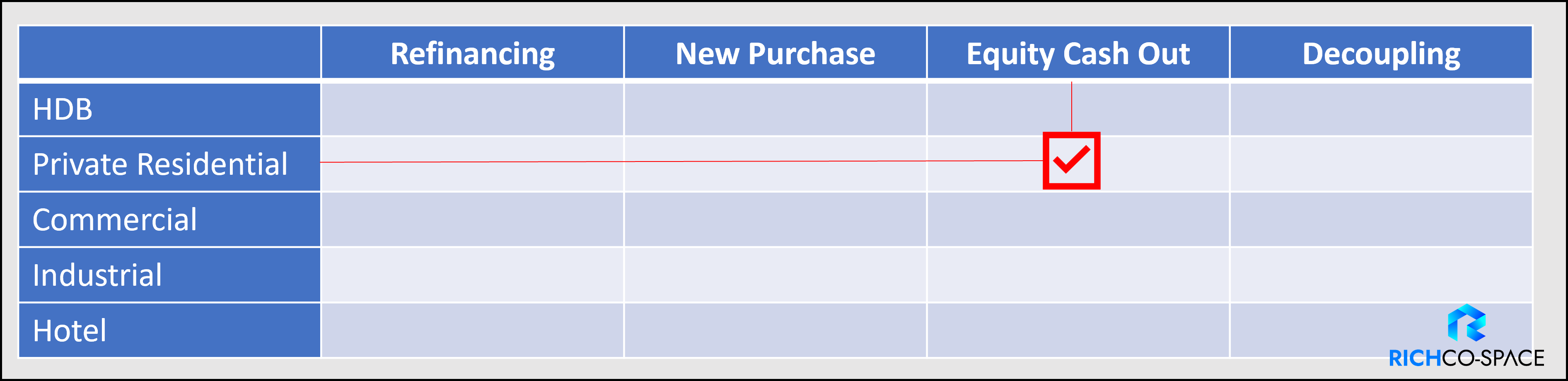

The following is a simple matrix table to identify your needs.

2. Flexibility – The length of lock-in period

Most mortgage packages come with a lock-in period. It ranges from 12 months to 60 months. Banks always impose a penalty of 1% – 1.5% for full redeemption within the lock-in period. The longer the lock-in period, the lesser flexibility.

There are three scenarios considered as full redemption: Refinancing, fully paid or selling your property.

Why is flexibility important?

If you were to choose a floating rate, it is crucial for you to have the minimum years of lock-in period. Just imagine, while the increasing interest rate results in the raise of your monthly installment. You will feel extremely helpless as you can’t do anything but see your savings accounts bleeding. You probably need to wait for another 2 – 3 years to cross over to the lock-in period timeline.

On the other hand, if the interest rate decreases, and your package still remains higher than other banks, you also can’t apply for refinancing to reduce some interest payment.

3. Always consider Fixed rate for hedging the interest rate risk

There is a saying about investment – “high risk high return”. In our view, it is not applicable for deciding mortgage packages. In the mortgage context, the risk is always the spike of interest rate or the gradual increase of interest rate. By choosing a floating rate, the risk is always higher than a fixed rate. This type of risk won’t bring any investment return per se. The downside risk is uncertain.

Over the past 1 – 2 years, we notice that fixed rate packages were only slightly higher than floating rate, in the range of 0.2% – 0.5%. Although it is slightly higher, in our opinion, there is no point in getting yourself exposed to interest rate risk by saving 0.5% interest. You potentially pay more due to the interest rate keeps increasing.

Fixed rate is always a good tool for hedging the interest rate risk.

4. Interest rate comparison.

Nowadays, bank interest rates are quite competitive. In terms of percentage, the differences could be only about 0.5% for the next 24 – 36 months. In short, there is not much difference between A bank and B bank and C bank.

In our view, interest rate comparison is considered the least important. The best rate package may not be able to meet your loan tenure requirement or equity cash out amount. That’s the reason, we do not provide typical bank loan comparisons on our website. Bank mortgage packages are not conventional products, which you can determine based on price itself.

Approach us for your mortgage needs today. Click here. It is free. We assure you that all your information and documents will be handled with utmost P&C.