If you’re a property investor or businessman in Singapore, you may be concerned about your borrowing capacity. By understanding your borrowing capacity, you’ll be better equipped to make informed decisions about your finances. Bank loans can be a useful tool for increasing your wealth, as long as you use them wisely.

With stricter borrowing rules in place in Singapore, it’s important to prepare well before applying for a mortgage. In general, a higher income leads to a higher borrowing capacity, while a higher existing loan commitment reduces your borrowing capacity. Here are some ways you can enhance your borrowing capacity:

Reduce your other loan commitments.

When you apply for a mortgage, the bank will review your credit bureau report to assess your credit rating and other loan commitments, including credit card loans, personal loans, car loans, and other housing loans. These commitments will reduce your loan capacity, and in some cases may make you ineligible for a mortgage or limit the amount you can borrow. If your borrowing capacity is impacted by your existing loan commitments, you may want to consider ways to pay off some of these debts before applying for a mortgage. For example, if you have a small car loan, you could consider paying it off before applying for a mortgage.

Cancel unsecured loans.

You may have been approached by banks to apply for a personal loan or personal credit facility. These are classified as unsecured loans and are easy to apply for, especially if you have a high salary. However, these loans can significantly damage your credit rating and reduce your borrowing capacity for property purchases. We do not recommend taking out unsecured loans if you don’t have a cash flow problem. Instead, try to spend within your means. For example, if you make $10,000 per month and have an unsecured loan with a monthly installment of $3,000+, your original borrowing capacity could be reduced by $500,000 when you apply for a mortgage.

Maintain good repayment habits for a good credit rating.

Singapore’s credit bureau report includes information about your repayment habits, including default payments, late payments, and revolving balances. Any of these factors can damage your credit rating. To maintain a good credit rating, try to:

- Avoid default and late payments by always paying your monthly credit card bill and other loan commitments on time.

- Avoid a high revolving balance by paying more than the minimum payment on your credit card bills.

Enhance your income.

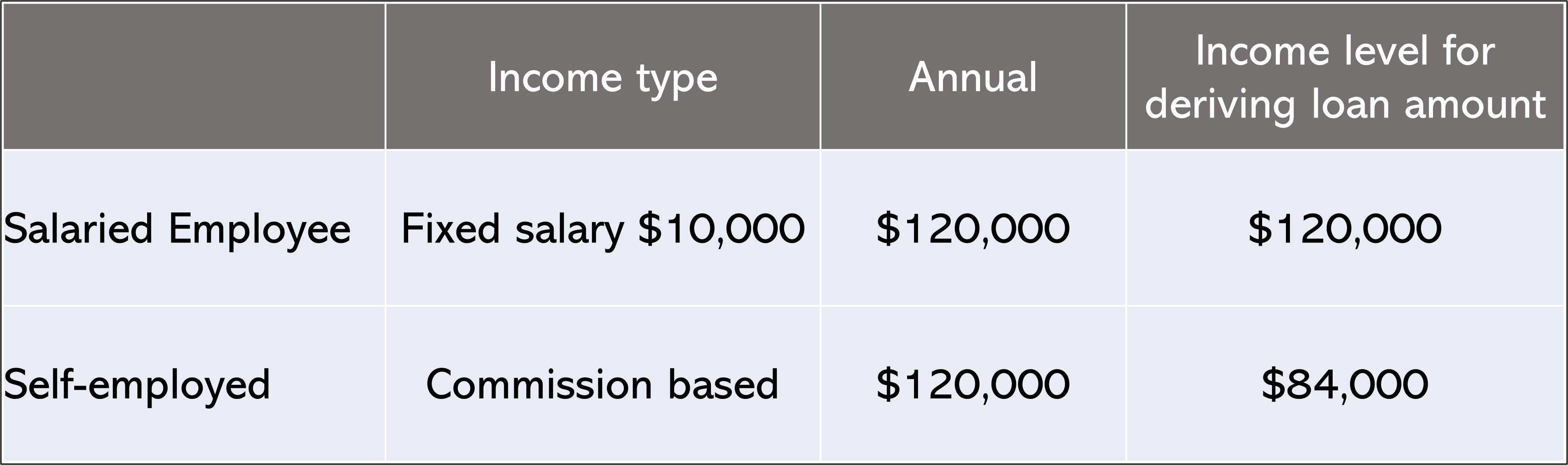

There are different rules for salaried employees and self-employed or business owners when it comes to calculating your Total-debt-servicing-ratio (TDSR).

- For salaried employees, your monthly salary and fixed allowances are counted 100% in the TDSR calculation, while bonuses and incentives are considered variable income and subject to a 30% haircut.

- For self-employed or business owners, your annual income is subject to a 30% haircut in the TDSR calculation. This means that if you compare two people with the same income, age, and loan commitments, the salaried employee will have a higher maximum borrowing capacity.

This rule can reduce the borrowing capacity of self-employed or business owners by a significant amount. Some banks may recognize a business owner’s fixed salary by requiring proof of a consistent salary amount and timing, a formal itemized salary slip, and a company with a few years of operation.

Show your liquidity assets.

When you apply for a mortgage, the bank will consider your liquidity assets, such as cash and investments, as well as your debt-to-income ratio. To maximize your borrowing capacity, try to increase your liquidity assets and reduce your debt. For example, you could sell stocks or other investments to free up cash, or pay off high-interest debts to reduce your debt-to-income ratio.

Consider a joint application.

If you’re unable to meet the borrowing criteria on your own, you may want to consider a joint mortgage application with a spouse or family member who has a higher income or better credit rating. This can increase your borrowing capacity and improve your chances of being approved for a mortgage.

By following these steps, you can increase your individual borrowing capacity and improve your chances of securing a mortgage in Singapore. If you have any questions or need further assistance, don’t hesitate to contact us for more information or try our Maximum Borrowing Capacity calculator.