We created this calculator, specifically to answer the question – “How much MAXIMUM I’m eligible to loan?”

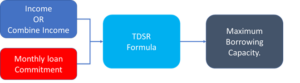

Since the implementation of Total-Debt-Servicing-Ratio (TDSR), all banks are required to evaluate the applicant’s borrowing capacity based on the MAS TDSR formula, regardless of the borrower’s relationship with banks or their occupation.

Your borrowing capacity is always directly proportional to your income and liquidity asset; It is inversely proportional to your other loan commitments and your age.

In addition, in terms of deriving your maximum borrowing capacity using TDSR formula, it is required to consider the sources of incomes – fixed salary or variable income.

The following three tables illustrate the impact of borrowing capacity:

- Same age, different level of income

| Person A (age 32) | Person B (age 32) | |

| Monthly fixed salary | $10,000 / month | $15,000 / month |

| Loan commitment | – | – |

| Max. loan capacity (Resi) | $1.28 mil | $1.93 mil (It $600,000 more) |

- Same age, same level of income and DIFFERENT level of loan commitment.

| Person A (age 32) | Person B (age 32) | |

| Monthly fixed salary | $10,000 / month | $10,000 / month |

| Loan commitment | $2,500 / month | $4,500 per month |

| Max. loan capacity | $704,000 | $235,000 (It is about $500,000 less) |

- Same age, same level of income and DIFFERENT in income sources (salaried employee & self-employed)

| Salaried employee (age 32) |

Self-employed (age 32) |

|

| Monthly income | $10,000 fixed | $10,000 average |

| Loan commitment | – | – |

| Max. loan capacity | $1,280,000 | $900,000 (About $380,000 less) |

After going through the above three tables, we hope that you have a better understanding about how the level of borrowing capacity will be affected by your income, purchase of other big ticket items and utility of personal facilities.

The borrowing capacity is a crucial personal’s financial parameter for today’s working adults and families especially when you come across a good buy opportunity.

Here are the tips to maintain your borrowing capacity. <link to a blog page>

Do a self-assessment by clicking here or consult our team.

Other

No Additional Fee payable to RICHCO-SPACE if you apply for a bank mortgage via RICHCO-SPACE.

We assure you that all your information will be kept confidential.